Catena Investments’ core value is to create added value with a positive impact on the world. This implies that we are committed to also have a positive ecological impact on our environment. Catena has build a portfolio of clean energy assets over the years which more than offsets our entire group’s carbon footprint. Hereby, we present the main features of our Ecological Footprint Report 2020.

Ecological Footprint

Ecological footprint (or carbon footprint) is a carbon profit and loss (P&L) statement: an overview of the impact of all core activities and investments on the environment. The carbon P&L statement states the avoided carbon emissions, CO2 profit, and the emitted carbon, CO2 loss. In measuring this carbon footprint we follow the protocols as dictated by the Green House Gas (GHG) protocols.

Framework

Our public funding operations are aligned with ICMA Green Bond Principals (GBP). By adopting these principles our Green Bond Framework:

- ensures that the use of proceeds aligns with our long term strategy and the ICMA GBP;

- provides a general framework in which owned and managed portfolios will be selected and evaluated and the use of proceeds are aligned with the eligible categories under the GBP;

- defines reporting requirements for transparency towards all our stakeholders.

In 2020, we have enhanced and improved our Green Bond Framework and several company policies. In particular, we have improved selection process of new investments and the selection of suppliers within the supply chains of our portfolio companies.

Through our work we aim to advance, among others, the following Sustainable Development Goals (SDG):

Second Party Opinion

In relation to a green bond issuance of portfolio company First Green Capital, Catena requested a Second Party Opinion (SPO) to evaluate its ecological and social impact. This includes the suitability of processes to select funded projects, transparency as well as the company’s internal sustainability policies. The SPO was conducted by Reinhard Friesenbichler Unternehmensberatung (rfu), an Austria based provider of sustainability research, audits for sustainable financial products and other services related to sustainable investment.

Our Green Bond Framework received an above average rfu-sustainability rating; B+. This B+ rating is the equivalent of the top 15% of all businesses with regards to their ecological and social impact. This can be attributed most importantly to its strategic focus on ecological impact investment and its contribution to energy transition and efficiency.

Investment Portfolio Composition

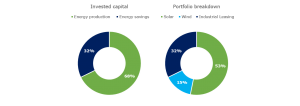

This section only considers the direct impact from our investments, and not the impact by advising companies realizing their sustainability goals. Catena’s portfolio of clean energy assets produces and saves energy. The figure below shows the amount of capital invested in assets that produce and save energy, and states a breakdown of the specific assets. Data as per 31 December 2020, excluding pipeline.

Catena’s production portfolio consists of 22% wind and 78% solar, and Catena’s savings portfolio consists of 95% industrial leasing.

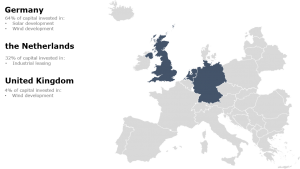

The geographical impact of Catena is illustrated in the figure below:

Our Ecological Footprint

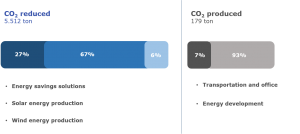

Catena’s ecological footprint is shown in the figure below. Data as per 31 December 2020, excluding pipeline.

Through active investments Catena realized an annual reduction, for the year 2020, of 5.333 ton CO2. Catena realized a carbon profit; the goal is to continue this annual reduction and to enlarge the positive impact by increasing our portfolio in the foreseeable future.

Do you have any questions? Please contact us at info@catenainvestments.com.